Debt Calculator Case Study

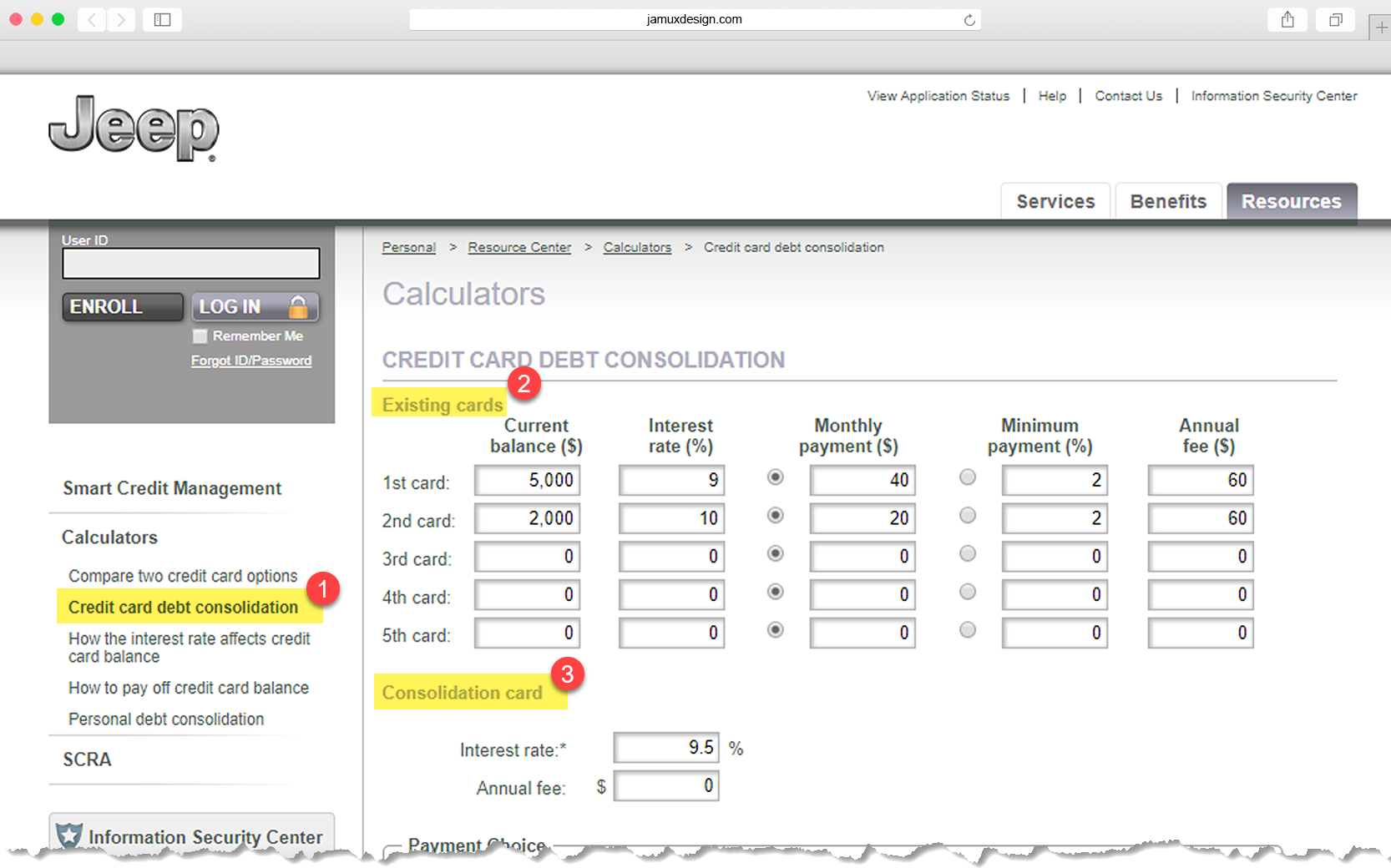

Consumer credit card holders have a goal to determine what the cost/benefits are from consolidating their debt to a First National financed credit card. In the consumer credit card redesign, we included a debt consolidation calculator to incentivize consumers to consider consolidating their credit card debt to FNBO.

Project Summary

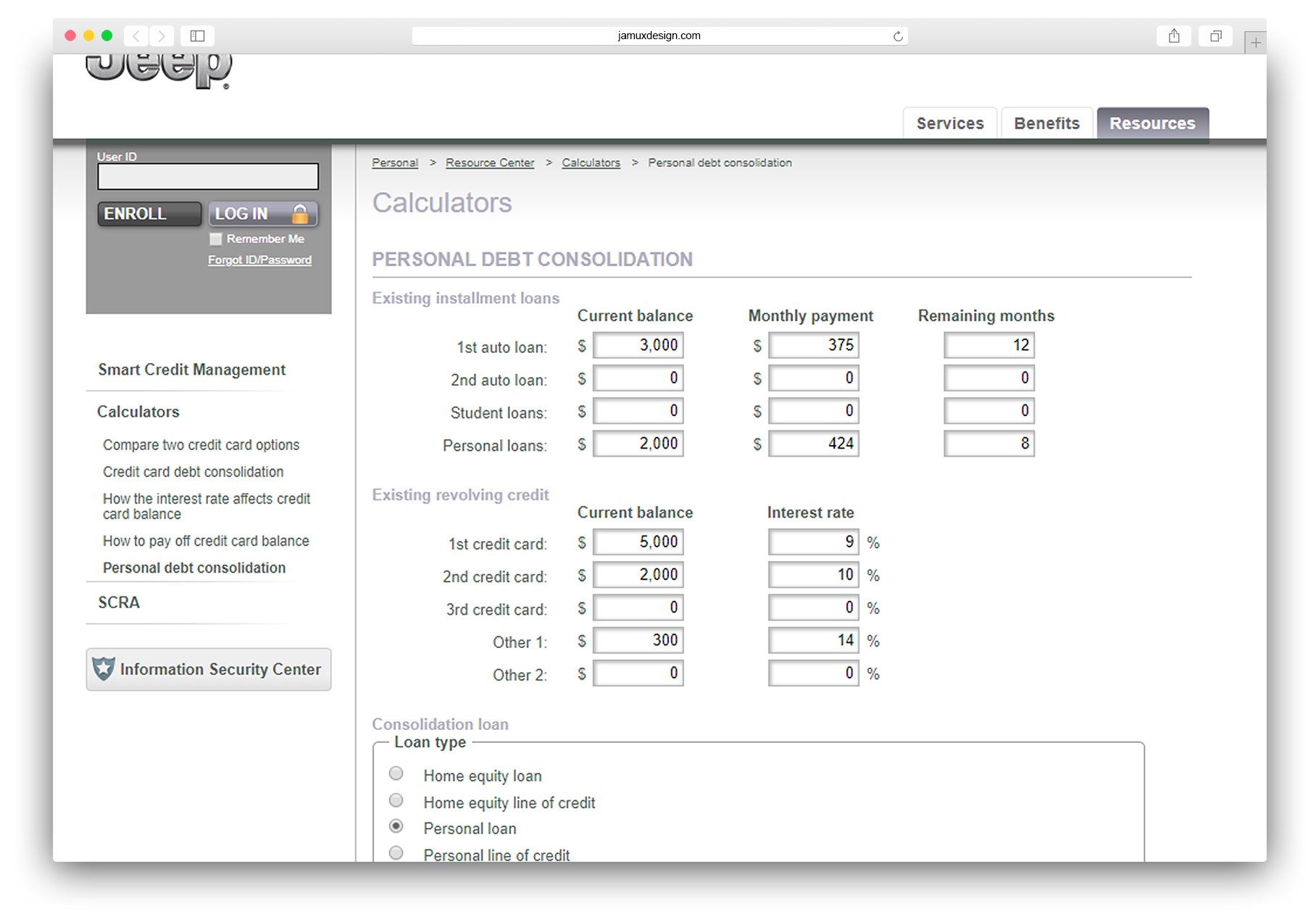

The redesign of the FNBO consumer credit card site (along with branded partnerships such as Jeep, Scheels, etc.) included a series of calculators for consolidating credit card and other forms of debt. The intent was to allow consumers to plan for and entice them to transfer debt to a First National Bank product.

①

A suite of calculators are made available based on common inquires from debt consolidation consumers.

②

In this example, a user can input their existing credit card(s) balance, interest rate, monthly payments, annual fee, and minimum payment amounts.

③

Enter the interest rate and annual fee…

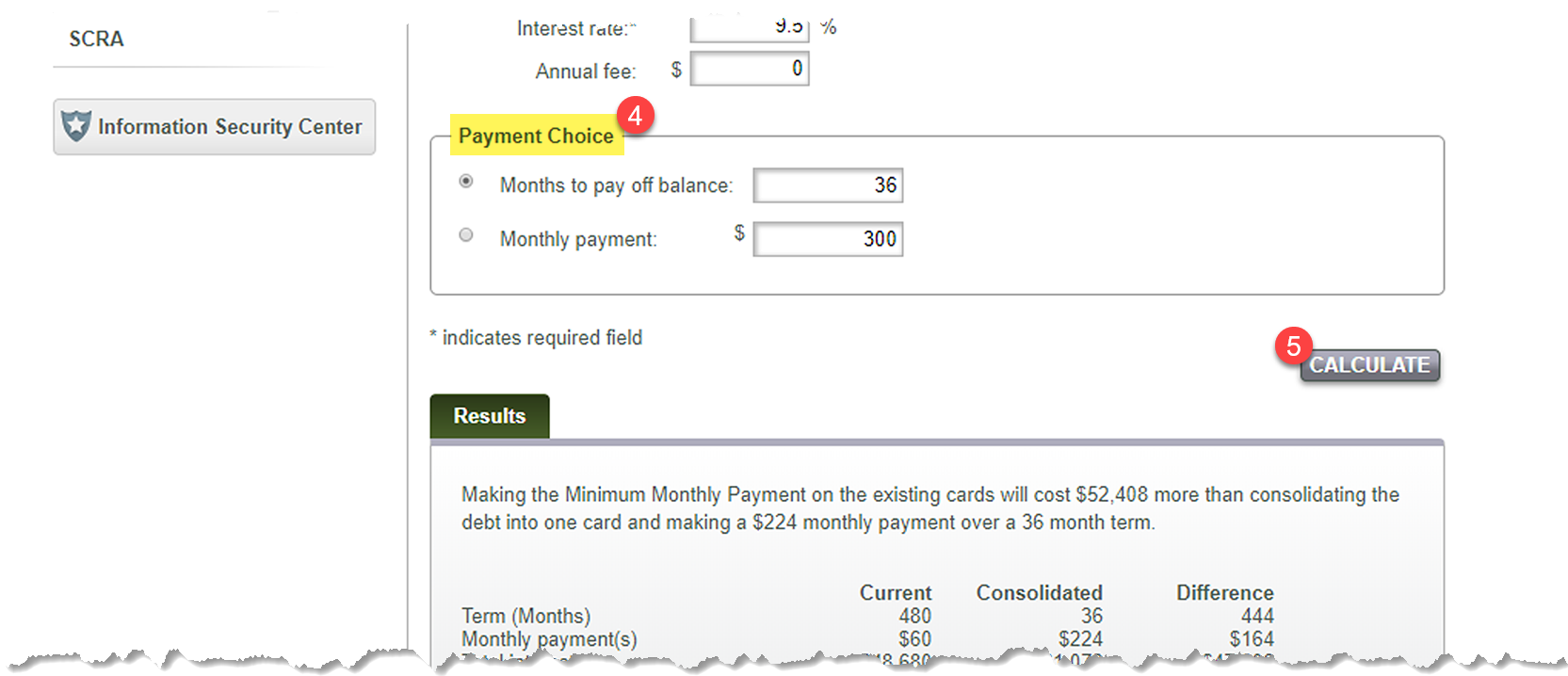

④

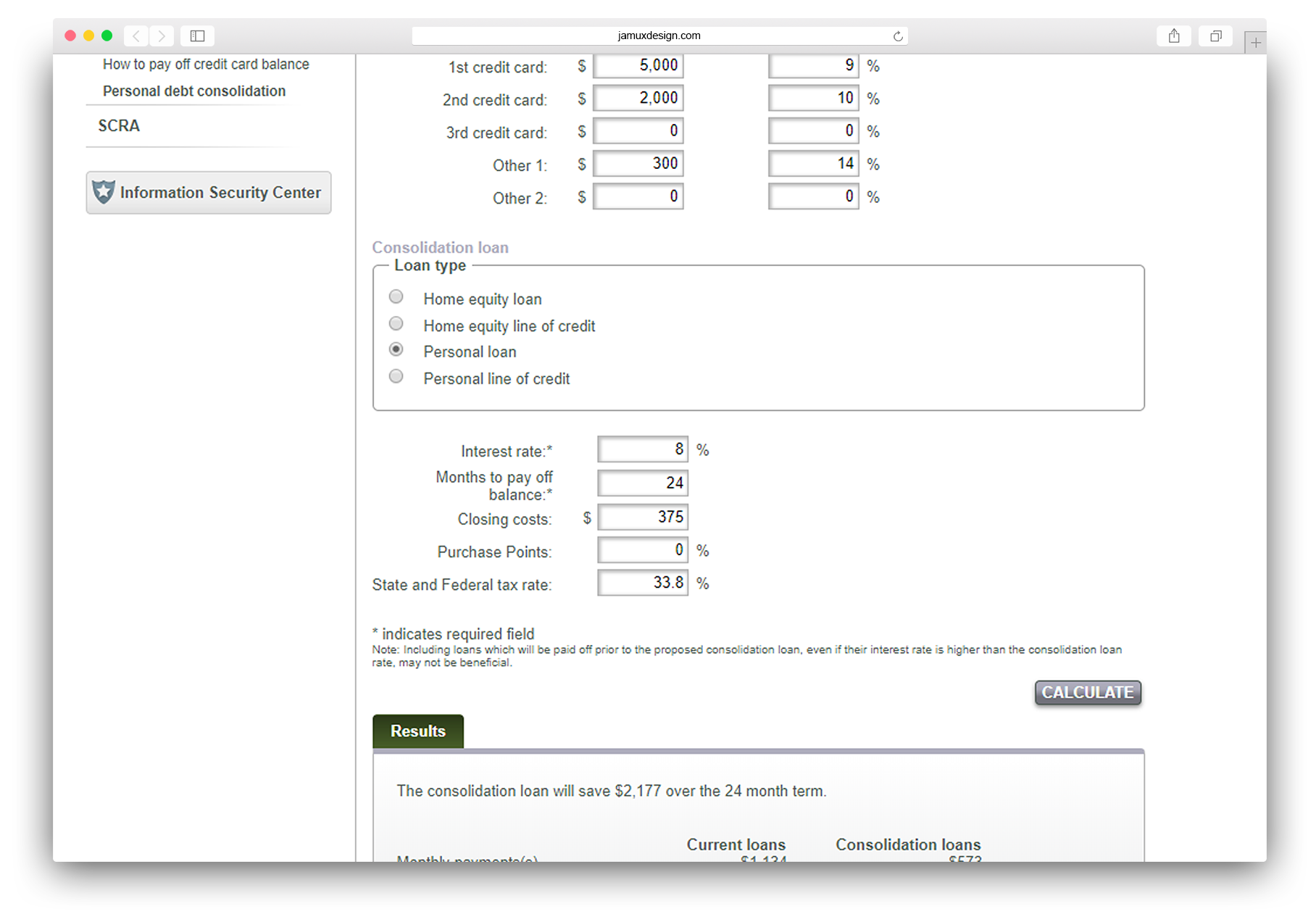

Enter months to pay off balance or monthly payment – this is entirely dependent on what the consumer wants or feels is manageable.

⑤

Once all the appropriate criteria is filled out, hit the calculate button…

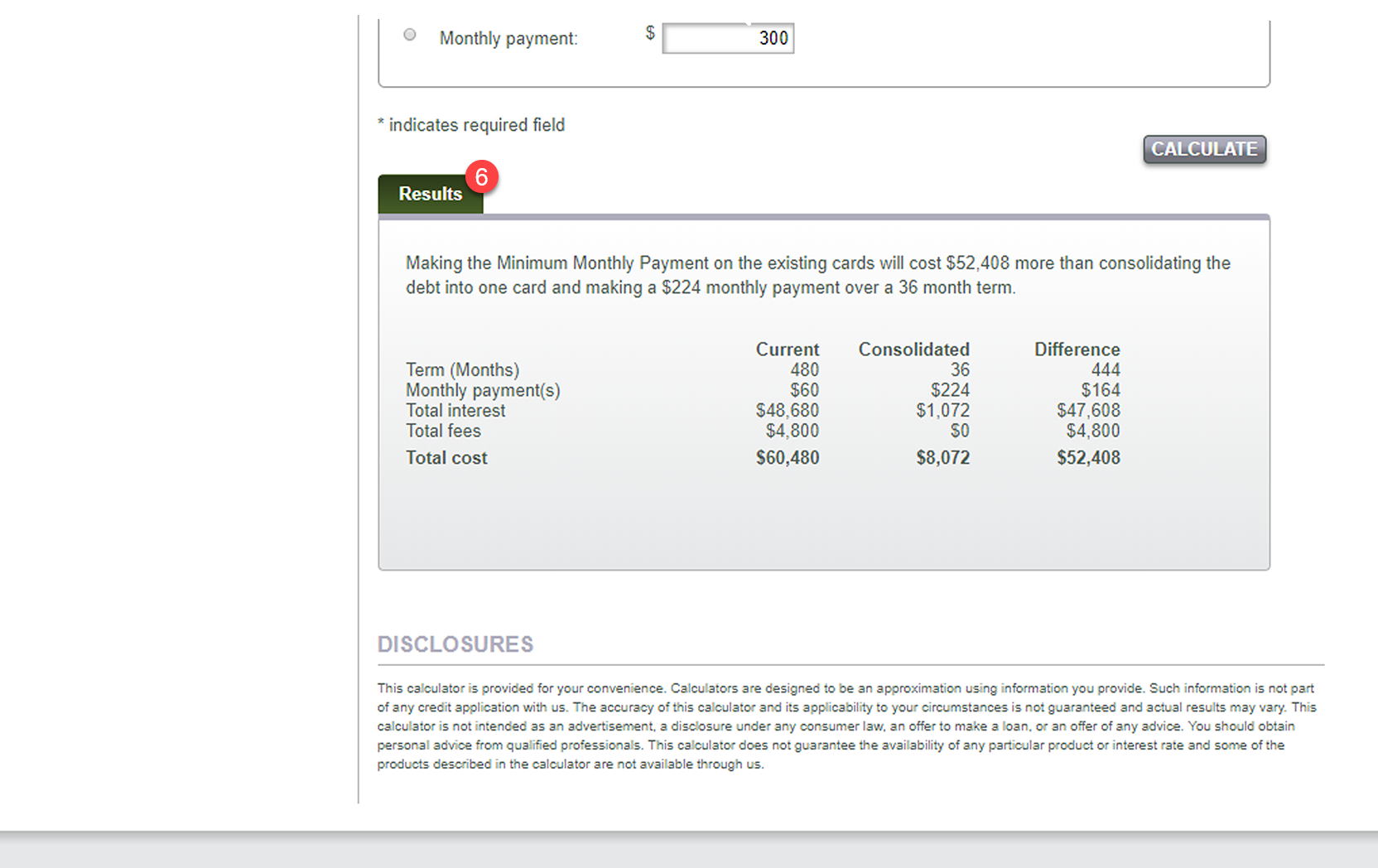

⑥

The results are displayed in the results tab. The consumer can change input values and re-calculate to their hearts content. Calculators are way to make consumers feel in control and demonstrate the value of FNBO debt consolidation.

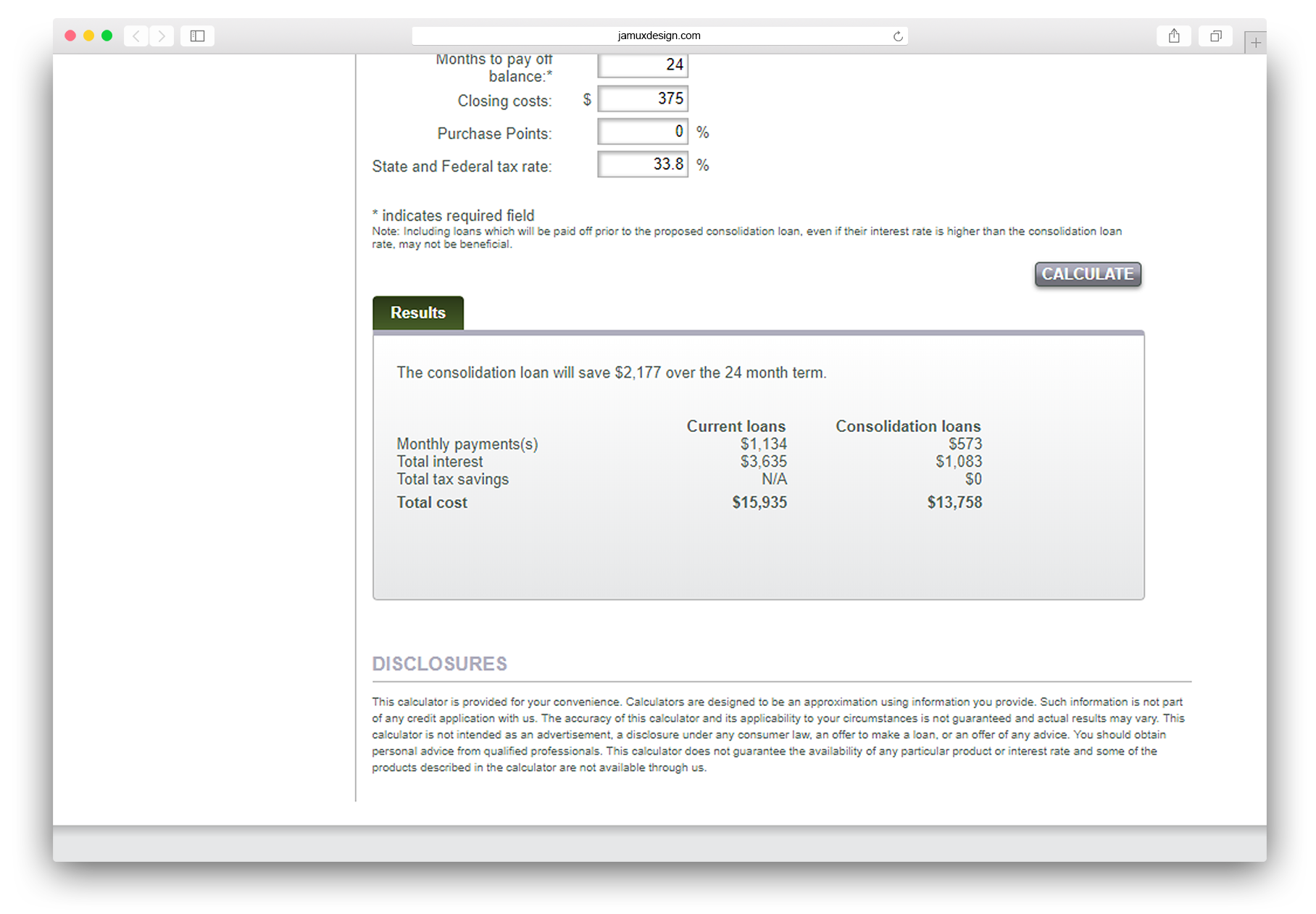

Personal Debt Consolidation Calculator

The Personal Debt Consolidation calculator allows the consumer to discover the cost of Personal Loan, Home Equity Loan, LOC, and Auto Loan. FNBO offers a variety of debt solutions and providing a means to know exactly what the cost/benefits are is a win-win for the business and the consumer.