Balance Transfer

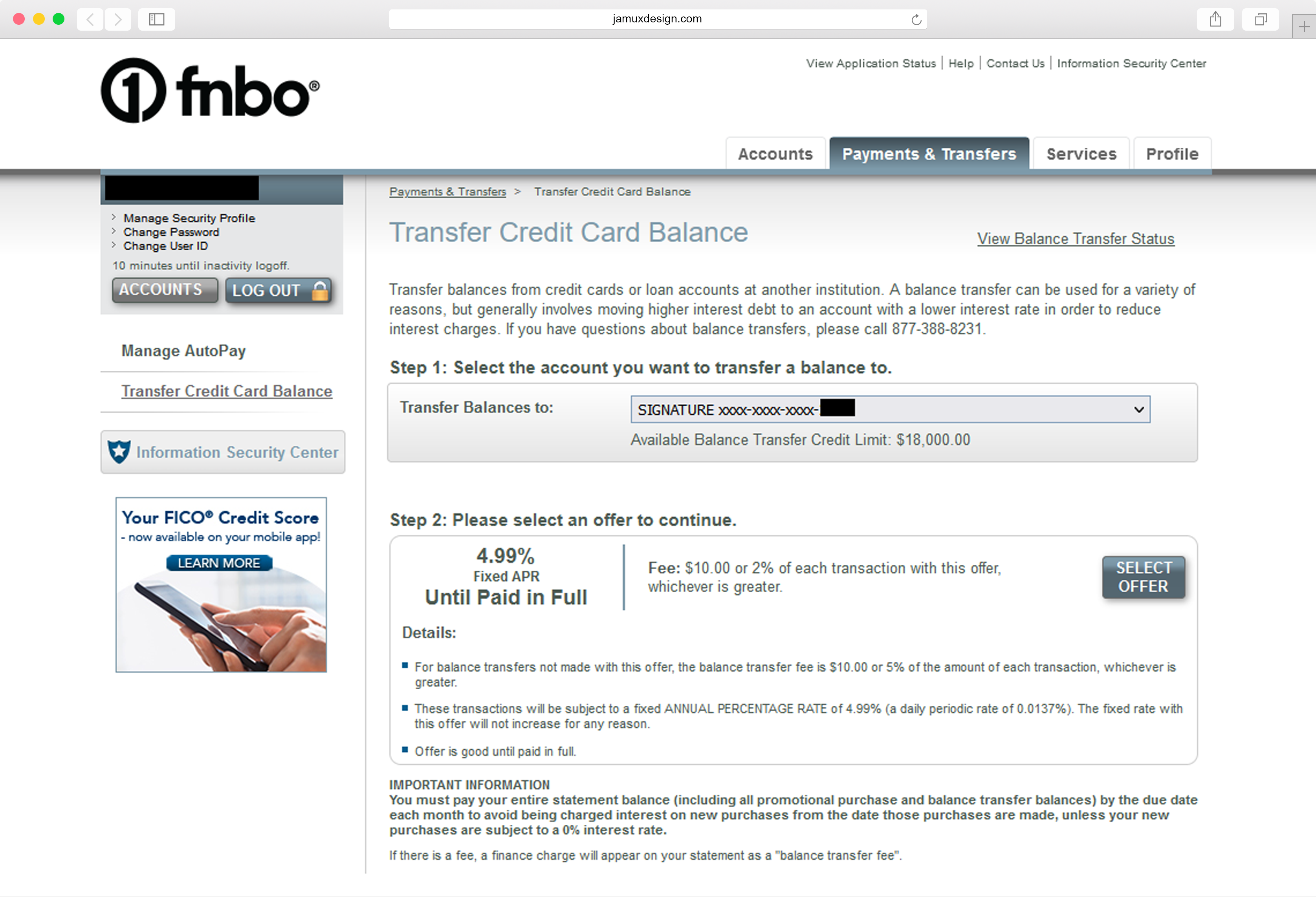

The majority of consumer credit card balance transfers were being done via balance transfer “special offer” mailings enclosed with paper checks for the account holder to use to transfer external credit balances to their FNBO credit account. Balance transfers were available online, but the conversion rate was exceedingly low and the business wanted to reduce the number of offer mailings.

Goal: Increase online balance transfers and reduct the number of mailed offers.

Results: 40% increase in online balance transfers and significant reduction in mailed offers.

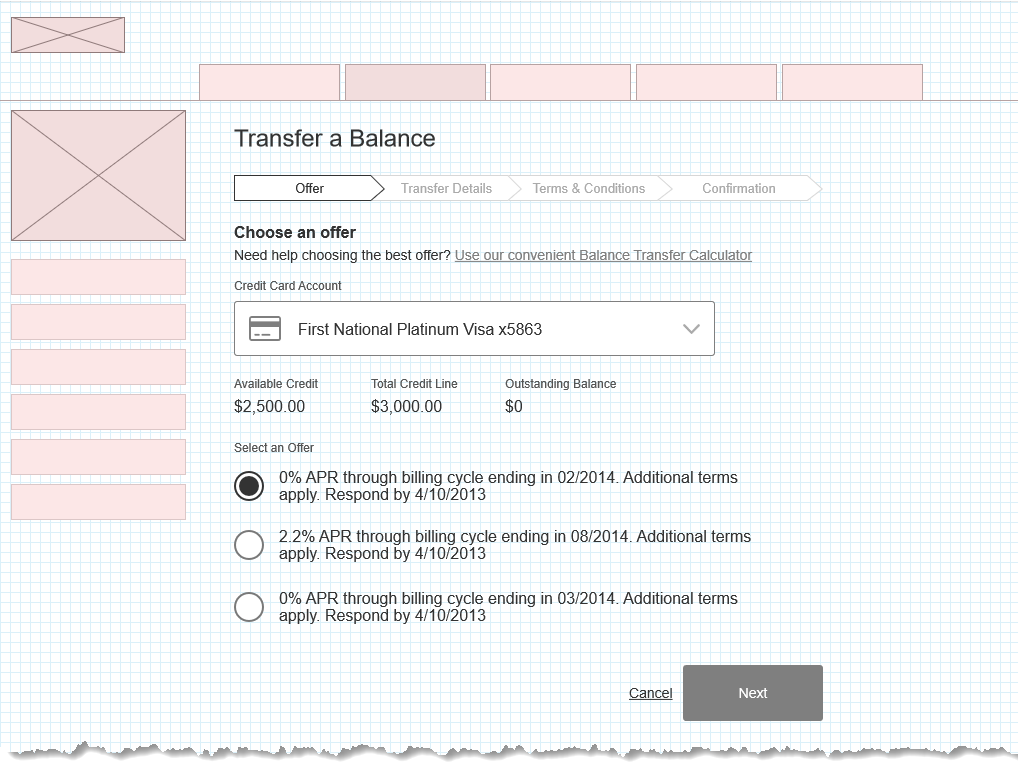

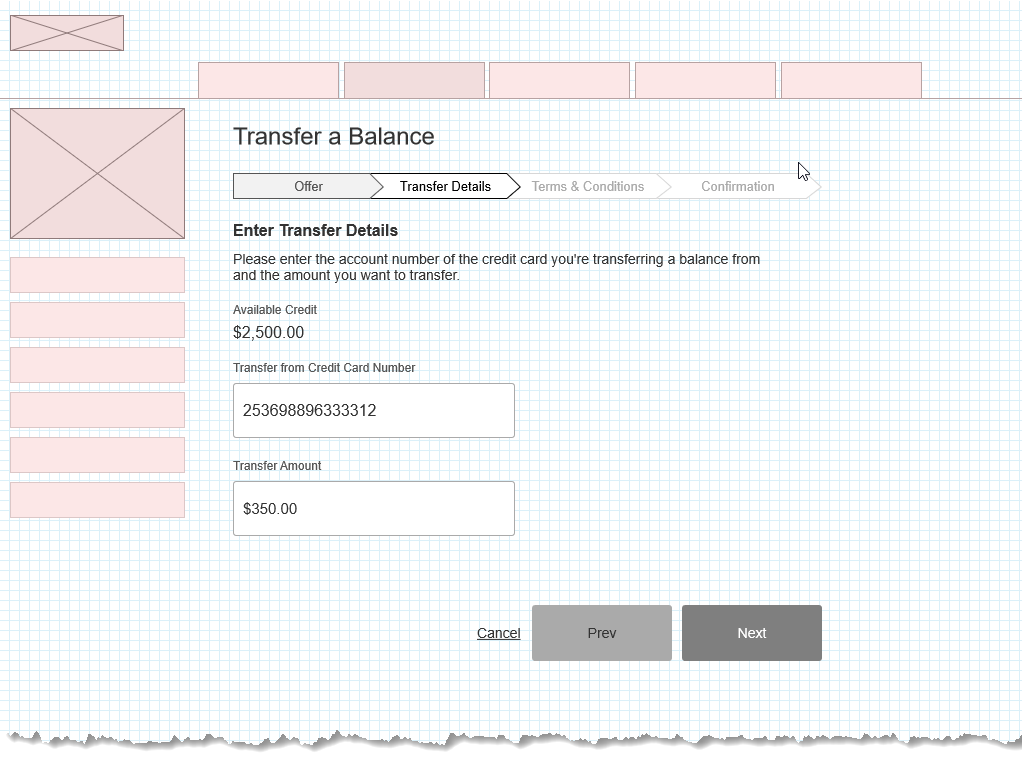

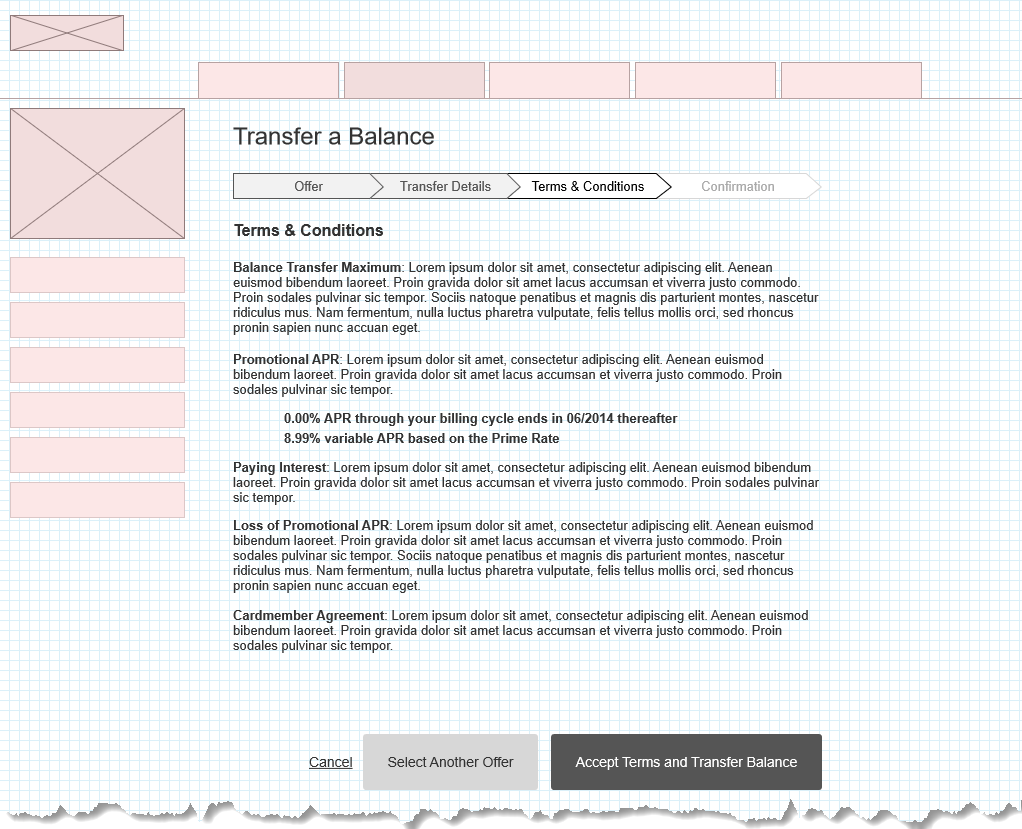

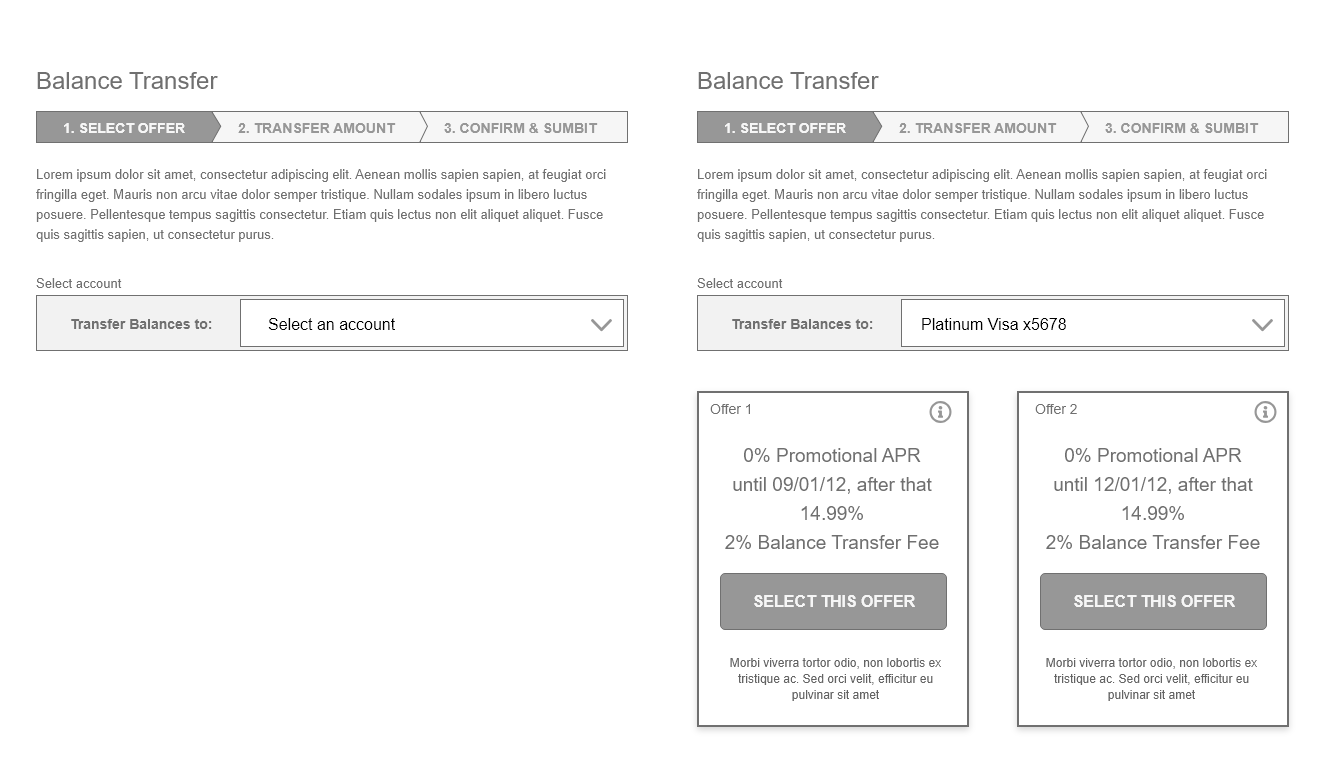

Demonstrate concepts through wire framing

A fast and iterative way to explore options (with established design system) and to engage project stakeholders on the desirability triad. I partnered extensively with product owner and analyst to determine the optimal design to achieve the business goals.

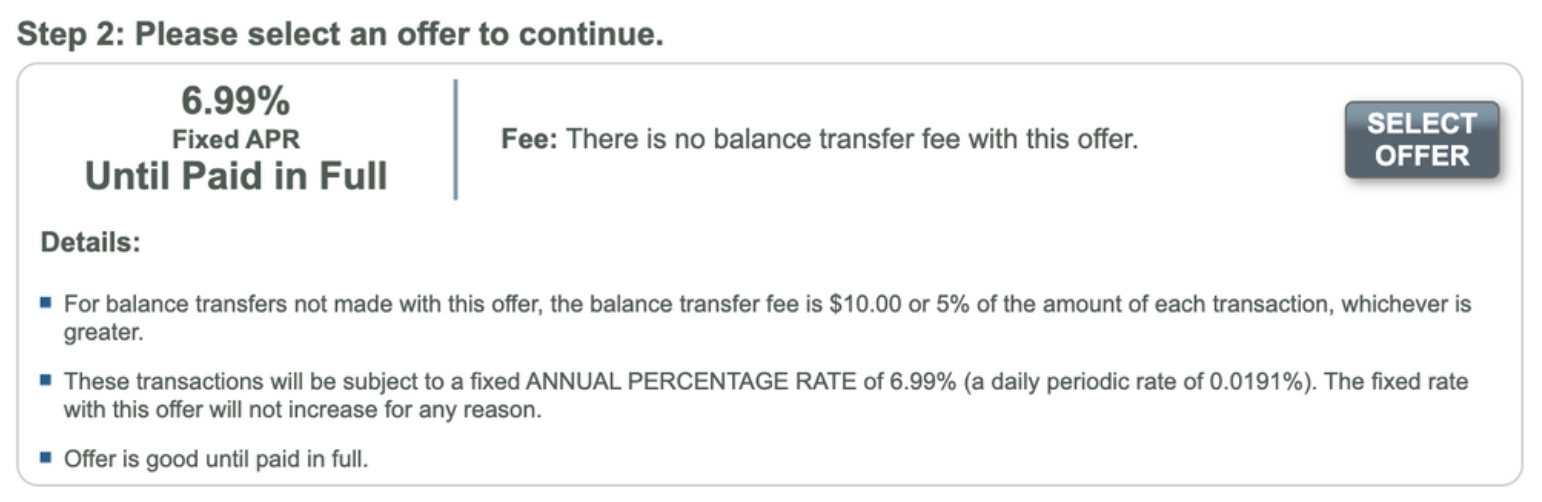

Prominently Display Offer in Clear Terms

After working with Product Owner and other relevant stakeholders with wireframe concepts, I mocked up finished prototypes with various use case scenarios.